Today’s Students Deserve Their Fair (Data) Share

Introduction Postsecondary credentials are a good investment for individuals, families, and communities. Yet college tuition and fees have increased at a much faster rate than financial aid. As college costs continue to rise, along with food and housing prices caused by inflation, students still need to meet the most basic necessities of living. But meeting…

Read MoreShort-Term Pell: Expanding Opportunity and Widening Pathways for Today’s Students

Introduction For over 50 years, the Pell Grant, a cornerstone of federal financial aid for today’s students, has supported millions in accessing higher education. In the 2021-22 academic year alone, 6.1 million students utilized the Pell Grant to take one step closer to reaching their educational and career goals. As the cost of postsecondary education…

Read MoreThe Numbers Speak for Themselves: Using FAFSA Data to Secure Today’s Students’ Basic Needs

Numbers Speak Basic needs insecurity adversely affects students’ well-being, as well as their college persistence and completion. Research shows that food and housing insecurity are contributing factors to lower graduation rates. Higher education funding alone is not enough to meet those needs. One solution is to ensure students access all available financial support, including means…

Read MoreBack to Basics: Solving Today’s Students’ Food, Housing, and Basic Needs Insecurities

The Basic Facts on Unmet Essential Needs A recent study found that three in five college students experienced insecurity in meeting their basic needs, such as housing and food. However, many federal safety net policies designed to support Americans in need were not created with today’s postsecondary students in mind. Research now shows today’s…

Read More101: Single Moms in Higher Education

101: Single Moms in Higher Education We met Kimberly Salazar, a single mother of a 5-year-old, last year during Higher Learning Advocates’ National Student Parent Month Fireside Chat. A first-generation student at University of California, Berkeley, and 4.0 GPA sociology major, Salazar was accepted into her school’s honors program for seniors. She also represents one…

Read MoreHow Credit for Prior Learning (CPL) Can Benefit Today’s Students

Higher Learning Advocates’ Credit for Prior Learning (CPL) Backgrounder offers an expert analysis that examines the roots of CPL and a 50-state table based on a nationwide review of CPL laws and legislation. Drawing on lessons learned from institutions nationwide, the policy paper puts forward three actionable recommendations for Congress that would allow today’s students…

Read MoreUpdated 101: Today’s Students

Today’s Students 101 Higher Learning Advocates’ Today’s Students 101 contextualizes who today’s students are and why their needs matter to help inform essential higher education policy conversations. Understanding who today’s students are is fundamental to creating a higher learning system that leads to their success. HLA’s Updated Today’s Students 101 features: The newest data…

Read More101: Means-Tested Federal and State Programs

Means-tested federal and state programs help millions of low-income Americans access housing, food, health care, child care, and more. But complex programs combined with myriad eligibility requirements can make it difficult for students to access these benefits. This 101 provides an outline of the programs, how each program is connected to college students’ needs, and…

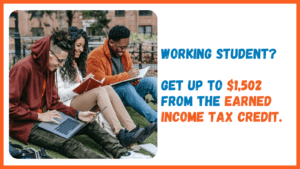

Read MoreCollege Students: You could get money from the Earned Income Tax Credit

This year, more people than ever before are eligible for the expanded Earned Income Tax Credit (EITC) –including college students age 18+ without dependents. This tax credit can give you back money, up to $1,502, to spend however you want – towards groceries, rent, a car, or more. All you need to do is file…

Read MoreFinancial Aid Officers: Help Students Get Money from the Earned Income Tax Credit

This year, more people than ever before are eligible for the expanded Earned Income Tax Credit (EITC) – including> college students age 18+ without dependents. This tax credit gives students back money, up to $1,502, to spend however they want – towards groceries, rent, a car, or more. All they need to do is file…

Read More